US Due for Debt Collapse

The US is due for a massive debt collapse – or hyperinflation. My prediction is that it will be at some point in the next 6 to 12 months. The result of this collapse is that we should expect to see the US dollar drop substantially further, sending commodity prices shooting through the roof.

US exported inflation (what I call ‘interflation’) will start to punish all of us for the largesse and excess that is destroying their economy.

Canada will benefit in the short term with oil prices driving the economy of Alberta and Saskatchewan to new levels, with royalties filling the coffers for everyone but eventually, we’ll have the same erosion of manufacturing and other industries throughout the rest of the country and Ontario will once again face financial issues as it tries to even catch up to the whirlwind that is coming.

The solution is to eliminate any pricing in US funds. If we remove ourselves from US dollar pricing, we may be able to avoid the Canadian dollar becoming a ‘petro-buck’, something that’s more of a curse than a benefit.

Here’s the original text of the piece from Zero Hedge:

#1: The US Fed is now the second largest owner of US Treasuries.

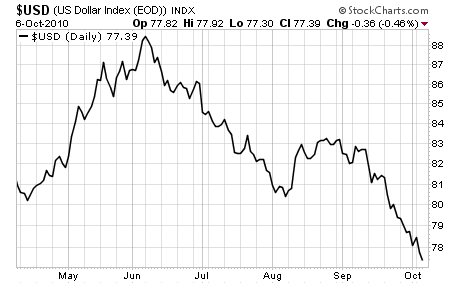

That’s right, this week we overtook Japan, leaving China as the only country with greater ownership of US Debt. And we’re printing money to buy it. Setting aside the fact that this is abject lunacy, this policy is trashing our currency which has fallen 13% since June… as in four months ago. Want an explanation for why stocks, commodities, and Gold are exploding higher? Here it is:

#2: “There are only about $550 billion of Treasuries outstanding with a remaining maturity of greater than 10 years.”

This horrifying fact comes courtesy of Morgan Stanley analyst David Greenlaw. And it confirms what I’ve been saying since the end of 2009, that the US has entered a debt spiral: a time in which fewer and fewer investors are willing to lend to us for any long period of time… at the exact same time that we must roll over trillions in old debt and issue an additional $100-150 billion in NEW debt per month in order to finance our massive deficit.

And only $550 billion of the debt we’ve got to roll over has a maturity greater than 10 years!?!?

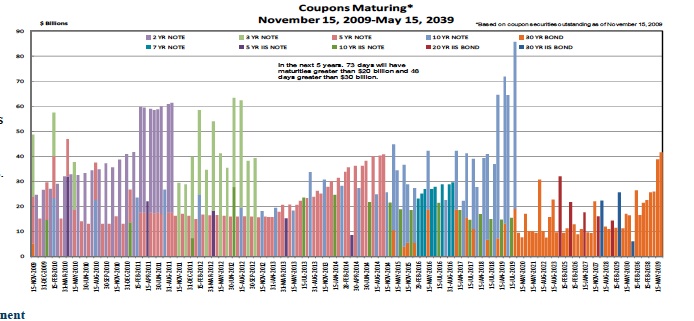

So we’re talking about TRILLIONS of old debt coming due in the next decade. The below chart depicting the debt coming due between 2009 and 2039 comes courtesy of the US Treasury itself. In plain terms, we’ve got some much debt that needs to be rolled over that you can’t even fit it on one page and still read it.

#3: The US will Default on its Debt

… either that or experience hyperinflation. There is simply no other option. We can NEVER pay off our debts. To do so would require every US family to pay $31,000 a year for 75 years.

Bear in mind, I’m completely ignoring the debt we took on with the nationalization of Fannie and Freddie, AIG, and the slew of other garbage we nationalized or shifted onto the Fed’s balance sheet. And yet we’re STILL talking about every US family making $31,000 in debt payments per year for 75 years to pay off our national debt.

Obviously that ain’t going to happen.

So default is in the cards. Either that or hyperinflation (which occurs when investors flee a currency). Either of these will be massively US Dollar negative and horrible for the quality of life in the US. But they’re our only options, so get ready.